Multiple Lender Connectivity

Connect borrowers with banks and NBFCs in real time.

Launch Your ONDC Loan Buyer Application with

Trust Fintech Limited – Revolutionizing Digital Lending

Get Your Loan Service Provider (LSP) Aggregator Business Online with ONDC

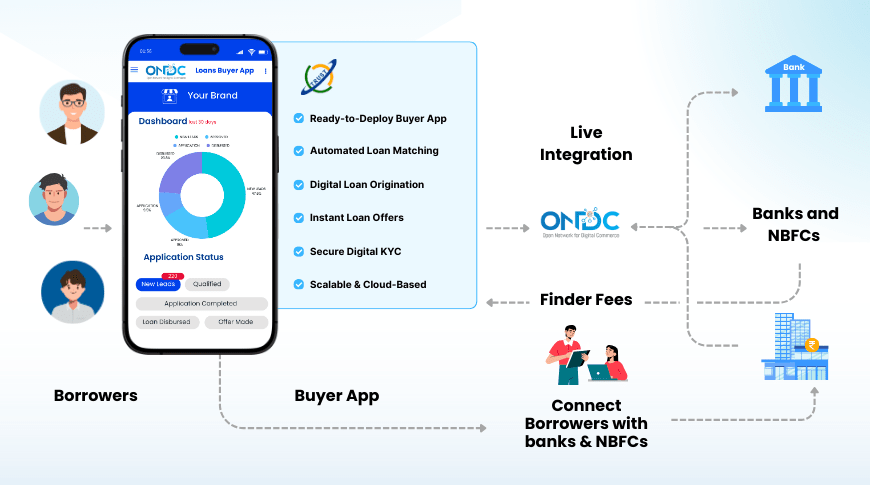

Start your journey as a Loan Service Provider (LSP) on the Open Network for Digital Commerce (ONDC). The ONDC Loans Buyer App lets you connect borrowers with banks and NBFCs while earning finder fees for every successful loan connection.

Trust Fintech Limited, an authorized Technical Service Provider (TSP) for ONDC, has developed a robust and fully tested Buyer Application. This platform enables LSPs to connect borrowers with multiple lenders in real time. Built on the ONDC framework, it delivers a seamless, fully digital loan origination experience while ensuring LSPs earn finder’s fees for every successful loan disbursement.

How the ONDC Buyer Application Works For Loan Service Providers (LSPs)?

Launch Your Buyer App

Get a fully branded Buyer App with Trust Fintech.

Attract Borrowers

Enable customers to apply for loans digitally.

Generate Loan Leads

Loan inquiries are broadcast to multiple lenders via ONDC.

Earn Assured Finder Fees

Get commissions for every successful loan disbursement.

Unlock the Potential of LSPs/ Loan Aggregator with ONDC Buyer Application

Connect borrowers with banks and NBFCs in real time.

AI-powered algorithms ensure the best loan offers.

100% paperless process from inquiry to disbursement.

Borrowers receive multiple loan options instantly.

Aadhaar, PAN, and video KYC integration for faster onboarding.

Fully adheres to RBI lending guidelines.

Earn finder fees on every successful loan disbursal.

Enables hassle-free EMI payments.

Connects easily with existing banking and lending systems.

Ensures high performance and growth.

Dedicated technical assistance for smooth operations.

Empower Borrowers with Seamless Loan Access

Enter personal and financial details.

Receive multiple pre-qualified loan options.

Secure digital document submission.

AI-driven assessment for faster processing.

Hassle-free EMI payments.

Funds transferred directly to the borrower’s bank account.

Benefits for Loan Service Providers (LSPs):

Reach a wider audience with loan inquiries from serviceable areas.

ONDC connects multiple sellers, ensuring diverse loan offerings.

High conversion rates due to an extensive pool of lenders.

Integrated e-KYC, credit rating, and automated underwriting.

Earn commission for every loan disbursed through the Buyer App.

Offer value-added loan advisory services.

Monetize borrower credit assessments and underwriting processes.

Expand Your Lending Business: Key Benefits for Banks & NBFCs

Access a Vast Borrower Base

Pre-Qualified Borrowers

Reduce Loan Origination Costs

Scalability

Trust Fintech Limited – Your Partner for Seamless ONDC Onboarding

Ready-to-Deploy Buyer App

Launch your loan aggregation business effortlessly.

Multiple Lender Connectivity

Real-time loan offers from banks and NBFCs.

100% Digital Process

Fully online from application to disbursement.

AI-Driven Credit Decisioning

Faster approvals with smart underwriting.

Secure & Scalable

Built on enterprise-grade infrastructure for high performance.